Personal Branding Strategy to Drive Growth and Success

There are many personal branding strategy that can be applied to enhance personal growth and success. However, not everyone truly understands these strategies. As a

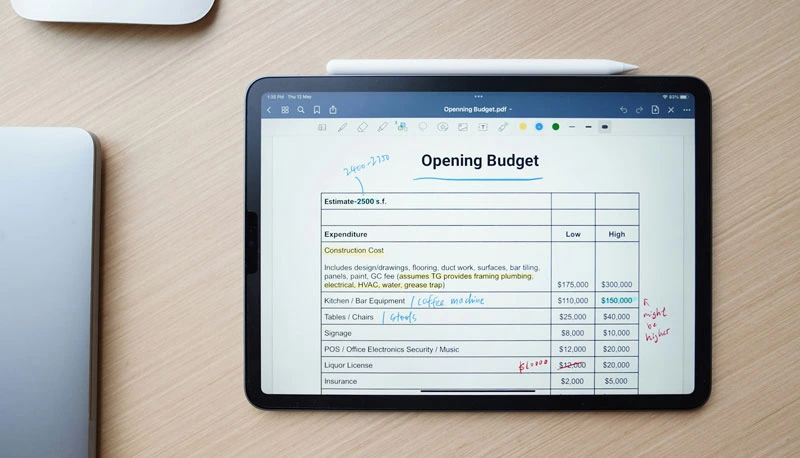

Understanding the important aspects of finance contributes to the success of both individuals and businesses. Financial management is often considered too difficult and complicated. However, financial management lies in how to wisely plan, budget, and control money according to needs. Well-organized memories help someone know where their money is. Meanwhile, for business needs, it will help the development of the company and the business owner. In fact, many factors influence business success, including financial management.

Finance also plays a fundamental role in company operations and must be managed properly through financial management. However, before understanding the financial aspects, it’s important to understand what finance is. Finance is key to the financial management process. The concept applies not only to individual finances but also to business needs.

This aspect encompasses all the key components that must be managed, analyzed, and planned. The goal is to ensure financial stability, survival, and growth for both individuals and businesses. This means it’s not just about recording incoming and outgoing money, but also about making strategic decisions based on that financial data.

The function of financial management includes a series of activities aimed at managing financial resources effectively and efficiently. The goal is to achieve financial goals, whether maximizing company value (for businesses) or achieving financial independence (for individuals). Several aspects influence finances, both in daily life and for company needs.

Investment is a crucial aspect of finance. This applies to companies. Investment differs from savings, as the potential for profit is much more dynamic than savings. Moreover, if you keep savings in cash, they won’t grow. Savings, on the other hand, are intended for urgent needs. Investment is a crucial part of a financial strategy that can maximize future finances.

Identifying and evaluating investment opportunities that can generate returns exceeding the company’s cost of capital is crucial. Even conducting business feasibility studies and using metrics such as Net Present Value (NPV) or Internal Rate of Return (IRR) before making major investment decisions.

The next important aspect of finance is income and expenditure. This aspect is the most fundamental aspect of everything related to finance. Income refers to incoming financial resources, such as salary, business income, interest, dividends, or sales proceeds. Meanwhile, financial resources are used to meet needs or obligations, such as living expenses, rent, employee salaries, or operational costs.

Financial management always begins with planning. Planning cannot be done without knowing exactly how much income is expected and where expenses will be allocated. Recording these two aspects is the first step to creating a realistic and disciplined budget.

To achieve financial stability, it is necessary to manage income and expenses appropriately. If expenses exceed income, it can be a sign of financial distress.

Risk management is an important aspect of finance that is never separated from finance. This risk management anticipates the emergence of market instability, foreign currency fluctuations, credit risk, and many other risks. This risk management can be achieved through insurance, financial portfolios, and the use of other investment instruments. While income and expenses determine current financial conditions, risk management determines future financial security and sustainability.

Risk management in a financial context means identifying, measuring, and taking action to mitigate potential future financial losses. Preventing major shocks from disrupting the entire financial structure that has been built.

Having an emergency fund provides a cushion prepared for job loss or urgent repairs. This prevents individuals from taking on high-interest debt or withdrawing investments prematurely. Risk management is about how one protects money from future losses. Both must go hand in hand to create truly healthy finances.

After understanding the important aspects of finance, be sure to learn the tips for managing them. Financial management plays a crucial role, not only for individuals but also for companies. This method is used to manage income and expenses. Here are some smart tips for managing finances well, including:

These are the functions, important aspects of finance, and tips for implementing them to ensure proper management of both individual and business finances.

There are many personal branding strategy that can be applied to enhance personal growth and success. However, not everyone truly understands these strategies. As a

Living in a temporary world often prevents a person from maintaining positive energy for various reasons. Life’s unpredictable and full of surprises can sometimes cause

Mastering personal finance often begins with a single concept budgeting for beginners. Many people struggle with saving money or controlling expenses because they never learned